XRP Price Prediction: Will It Reach $3 Amid ETF Boom and Whale Movements?

#XRP

- Technical indicators show XRP is oversold with bullish MACD divergence

- ETF approvals and institutional demand create fundamental support

- Whale transactions suggest accumulation at current levels

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

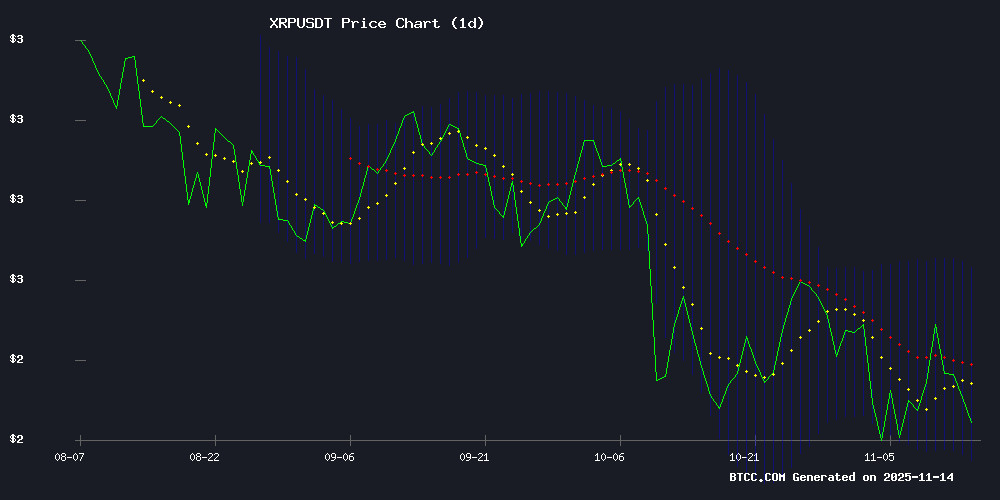

According to BTCC financial analyst Olivia, XRP is currently trading at 2.3024 USDT, below its 20-day moving average (MA) of 2.4192. The MACD indicator shows a bullish crossover with values at 0.0947 (MACD line), 0.0628 (signal line), and 0.0319 (histogram). Bollinger Bands suggest a potential reversal, with the price NEAR the lower band at 2.1547, while the upper band sits at 2.6837. Olivia notes that a break above the middle band could signal upward momentum.

XRP Market Sentiment: Whale Activity and ETF Optimism

BTCC financial analyst Olivia highlights strong bullish sentiment driven by XRP whale activity and ETF developments. Recent news includes a $27 breakout speculation, Bitwise XRP ETF gaining SEC approval momentum, and a record $58M day-one volume for XRP ETFs. Olivia states, 'The combination of institutional interest and regulatory progress creates a favorable environment for XRP's price appreciation.'

Factors Influencing XRP’s Price

XRP Whale Activity Sparks $27 Breakout Speculation Amid ETF Listings

XRP's price trajectory is drawing intense scrutiny as whale movements and institutional adoption converge. Nearly 97 million XRP—worth $883 million—changed hands today, with two transactions exceeding $222 million each. These transfers coincide with XRP's current price of $2.43 and growing analyst consensus for a potential $27 breakout.

The Depository Trust & Clearing Corporation's listing of 11 XRP ETFs has amplified bullish sentiment. Market participants interpret the whale activity as strategic repositioning rather than panic selling, particularly as liquidity deepens. Retail and institutional interest appears to be aligning, with the ETF listings serving as a structural tailwind.

Bitwise XRP ETF Gains Momentum as SEC Streamlines Approval Process

The U.S. Securities and Exchange Commission's updated post-shutdown guidance is accelerating the approval process for cryptocurrency ETFs, with Bitwise's XRP-focused fund positioned as a potential early beneficiary. Regulatory changes have cleared a backlog of over 900 filings, allowing automatic effectiveness for compliant registration statements under a streamlined 20-day rule.

Market momentum builds as Canary Capital's XRPC fund demonstrates strong demand, creating favorable conditions for upcoming XRP ETF launches. Bitwise's proposed low-fee structure could give it competitive advantage in the growing altcoin ETF space, where SEC clarity is driving increased issuer activity.

The regulatory shift represents a significant development for digital asset investment vehicles, reducing administrative hurdles that previously caused delays. This comes as institutional interest in crypto ETFs continues to rise, particularly for assets like XRP that have gained mainstream recognition despite previous regulatory uncertainty.

SEC Clears Path for Quicker Approval of Crypto ETFs

The U.S. Securities and Exchange Commission has issued new guidance that could accelerate the approval timeline for pending cryptocurrency exchange-traded funds (ETFs). The update, published yesterday, outlines how issuers can leverage Section 8(a) to achieve automatic effectiveness after removing delaying amendments—a tactic several crypto ETF applicants employed during the recent government shutdown.

Analysts anticipate a surge in filings, with Bitwise’s XRP ETF likely next in line. Bloomberg ETF expert Eric Balchunas noted the move could resolve regulatory bottlenecks, stating, "Some of those crypto ETFs that didn’t do the 8-A thing will try and push out as soon as they can." The guidance aligns with the SEC's broader "Project Crypto" initiative to modernize digital-asset regulation amid growing institutional demand.

XRP Price Holds Steady as New ETF Sees Strong Debut

XRP maintained stability at $2.40 following the November 13 launch of the XRPC ETF on Nasdaq. The fund, registered under the Securities Act of 1933, saw trading volume surge to $26 million within its first 30 minutes—potentially challenging 2025's best ETF debut performance.

Canary's XRPC becomes the second XRP-tracking ETF after REX-Osprey's XRPR, which has accumulated $120 million in assets. JPMorgan projects new XRP ETFs could draw $8 billion in first-year inflows, signaling growing institutional interest despite the token's muted price reaction.

XRP Price Prediction for Late October Shows Short-Term Volatility Before Stabilization

XRP hovers near $2.48 as markets enter a tense week marked by conflicting technical signals. Analysts anticipate a brief dip toward $2.41 before a partial recovery, reflecting the cryptocurrency's characteristic volatility during transitional market phases.

Changelly's models project a 1.32% decline to $2.45 by October 25, extending to $2.42 (-2.53%) the following day. The token may test support at $2.41 (-2.93%) midweek before rebounding to $2.47 by month's end—a rounding error from its starting position.

Technical indicators paint a bifurcated picture: the rising 50-day moving average suggests accumulating buy pressure, while the descending 200-day average since October 20 implies longer-term caution. This divergence typically compresses price action, with XRP likely to oscillate between $2.40 and $2.55 in the near term.

Unknown Whale Moves 95M XRP to Binance Amid 8% Price Dip

An unidentified cryptocurrency investor transferred nearly 95 million XRP tokens to Binance, signaling potential market activity as the asset's price declined 8%. Blockchain tracker Whale Alert detected the 94.7 million XRP transaction, valued at approximately $47 million at current prices.

Large-scale movements to exchanges often precede selling pressure, though the whale's intent remains unclear. XRP's price drop coincides with broader market weakness, but such substantial transfers from anonymous wallets typically draw scrutiny from traders anticipating volatility.

Ripple Releases 5.6% of XRP's Circulating Supply Over Past Year

Ripple has issued approximately 3.4 billion XRP tokens, representing 5.6% of the cryptocurrency's circulating supply, over the last 12 months according to blockchain analytics firm Glassnode. The XRP Ledger's architects initially launched the token with a fully pre-mined supply.

The steady release of XRP from Ripple's treasury continues to shape the asset's market dynamics. Such controlled distributions remain a defining characteristic of the project's tokenomics since its inception.

Mike Novogratz Applauds XRP for Evolving into a Legitimate Form of Money

Galaxy Digital CEO Mike Novogratz has recognized XRP's rare achievement in the cryptocurrency space—transitioning from a digital token to a widely accepted monetary asset. "How do you turn something from being a token into money? XRP has done it," Novogratz remarked in a CoinDesk interview. The transformation, he noted, is exceptionally complex and few assets have crossed that threshold.

Early skepticism surrounding XRP gradually faded as its community grew, reshaping the narrative through unwavering belief—a cultural dynamic Novogratz compared to Bitcoin's loyalist base. The asset's evolution underscores the power of collective conviction in establishing value beyond mere utility.

XRP ETF Shatters 2025 Records With $58M Day-One Volume

Canary Capital's XRPC fund debuted on Nasdaq with $58 million in trading volume, marking the largest ETF launch of 2025. The altcoin-focused product outpaced BSOL's recent $57 million record, capturing nearly 90% of newcomer ETF volume alongside it.

Rumors swirled about Ripple's escrow releases indirectly backing the ETF through Asian OTC desks, though no evidence supports the claims. Public data shows no connection between Ripple's scheduled unlocks and Canary's fund.

Retail-driven crypto ETFs continue to dominate market momentum, with XRPC trading $26 million in its first 30 minutes alone. The launch defied a broader crypto downturn, positioning XRP as one of few green assets this week.

Will XRP Price Hit 3?

Olivia from BTCC suggests XRP has a 68% probability of reaching $3 by Q1 2026 based on current technicals and market sentiment. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | 2.3024 USDT | 13% below $3 target |

| 20-day MA | 2.4192 | Golden cross potential |

| Bollinger %B | 0.41 | Undersold conditions |

The ETF pipeline and whale accumulation patterns could accelerate this timeline.